A Holiday Message For Employers

December 15, 2019 by Lincoln Derr

TIPS TO KEEP EMPLOYERS OFF OF THE “NAUGHTY” LIST

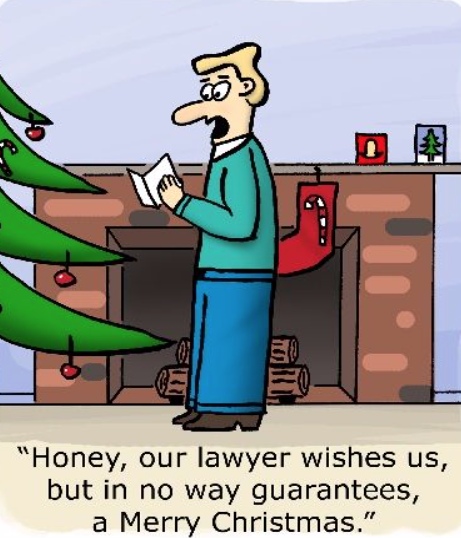

It’s an oldie, but a goodie – the lawyer Christmas card invoking dry legal-speak without overpromising – and just more

It’s an oldie, but a goodie – the lawyer Christmas card invoking dry legal-speak without overpromising – and just more

support for the notion that lawyers truly are the fun police.

While I’m not here to set the Bumpus hounds loose on your holiday feast (“A Christmas Story” reference anyone??), I do want to offer a little guidance on how to navigate this most wonderful time of the year!

With that in mind, here are a few tips to keep employers off of the “Naughty” list this holiday season:

Bonuses

To give or not to give – that’s often the big question this time of year for employers. Absent a written bonus agreement to the contrary, there is no requirement that employers pay employees a holiday bonus. However, if you’re trying to decide whether to fill your employees’ stockings with holiday cash, be sure to remember the difference between a discretionary and nondiscretionary bonus.

Discretionary bonuses are generally what you see handed out this time of year – an end-of-year bonus an employer gives to an employee that is not promised in a contract or based upon meeting certain benchmarks, such as sales quotas or total company revenue. Rather, it’s often given out to reward exceptional performance or a particularly successful business year.

As the name implies, a discretionary bonus is given solely at the discretion of the employer. The employer may decide how much and when to give a discretionary bonus or may decide not to give one at all. Employees should have no expectation of payment of discretionary bonuses and the payment has no effect on overtime rate calculations.

A nondiscretionary bonus is a bonus in which the employer does not have discretion over the amount or the timing of the payment and is considered to be a part of an employee’s total wages. Unlike discretionary bonuses, nondiscretionary bonuses are tied to specific goals or performance standards. Once the specified goals and performance standards are reached, the nondiscretionary bonus is earned and must be paid to the employee.

The amount and timing of the payment is often agreed upon in advance by the employee and employer. Because it is part of an employee’s weekly compensation, even if paid at the end of the year, it must be included in the calculation of a non-exempt employee’s regular wage rate for the period covered by the bonus.

For example, if the bonus period is the entire year, the nondiscretionary bonus must be added to the employee’s total earnings for the year and included in the calculation of the employee’s regular rate of pay. The employer must then use that new rate of pay to recalculate the employee’s overtime wages (if any). This will likely result in the employer owing the employee additional overtime compensation on top of what the employee has already been paid.

The bottom line? Employers should check their lists and check them twice when it comes to holiday bonuses because the fallout from a mishandled or mislabeled bonus is definitely not nice.

Office Decorations

While it might not surprise you to learn that Christmas trees, wreaths, and red stockings hung by the chimney with care are not religious symbols – menorahs, Mishumaa saba, and Nativity scenes are. If you deck the halls of your business with these symbols that do have religious connotations, you risk alienating employees and could end up with an EEOC Charge of Discrimination to ring in the New Year.

Unless your company is a religious organization or its general purpose and mission support a religion, you should consider the diversity of your workforce and decorate – tastefully or not – with secular, non-religious displays of the season. Just remember, a Clark Griswold-esque light and holiday display might be the distraction that lowers productivity and makes for a December that is neither holly nor jolly.

Holiday Parties

It’s true that the best way to spread Christmas cheer is to sing loud for all to hear. Even in economically uncertain times, about 85% of employers host some version of a holiday party. With most of these parties involving the consumption of alcohol, the chance for an employee to do or say something regrettable is very high. Did you know nearly 30% of extramarital affairs begin at office holiday parties? Or, that about 60% of employees will drink too much? Or, that roughly one-third of your employees don’t even want an office holiday party??

Holiday parties can be festive and fun or the source of real frustration. Consider these 6 Tips to avoid legal peril at your company holiday gathering:

- Make attendance optional (or conversely, don’t reward attendance) – required attendance can lead to everything from DRAM shop liability to a discrimination charge.

- Consider the location – avoid bars or other venues that emphasize or encourage excessive drinking.

- Set expectations in advance – let employees know that you want them to have fun and enjoy the party, but that you still expect professional behavior.

- Party planners – get your employees involved in the planning of your holiday party rather than relying on what you “think” your employees might like. Of course, set a budget!

- Think inclusivity – avoid parties that emphasize a particular religious holiday. Remember, your employees may not all celebrate the holidays the same way or even celebrate at all.

- Rethink the open bar. (No explanation necessary)

Happy New Year Courtesy of the U.S. Department of Labor

Don’t forget -the new U.S. Department of Labor (“DOL”) final overtime rule, which calls for a significant increase to the minimum salary threshold for overtime eligibility goes into effect January 1, 2020. Currently, employees paid at least $455 per week, or $23,660 per year, on a salary basis who also meet one of the DOL’s eight job duties tests are exempt from both minimum wage and overtime pay requirements. Under the new rule, that standard salary level will go to $684 per week (or $35,568 per year for a full-year worker) and will still need to meet the new one of the job duties tests in order to be exempt from the FLSA’s overtime pay requirement.

Employers may credit non-discretionary bonuses, incentives, and commissions toward an employee’s salary level, as long as those bonuses are paid at least annually. Those bonuses may only account for up to 10% of the employee’s salary. The standard salary level for “highly compensated employees” is also increasing – from $100,000 per year to $107,432 per year.

While we’re on the subject, January 1stis a great time consider it a New Year’s check-up for the health of your HR department or HR-related policies. Well-written, easy to read employee policies go a long way in setting employee expectations and preventing issues that might land your company in front of the EEOC, the DOL, or a jury of twelve. And if that’s not enough motivation, remember – spending the time and money now to update your policies could save you money in the long run.

Employment law is one of the most rapidly changing areas of law, so pull out that employee handbook and make sure that your policies and procedures comply with the most current federal, state, and local laws. Lincoln Derr can help guide guide you through the update process to ensure your company has a happy and healthy year.